Looking at Recent Market PULLBACK in a Long-Term Context & More!

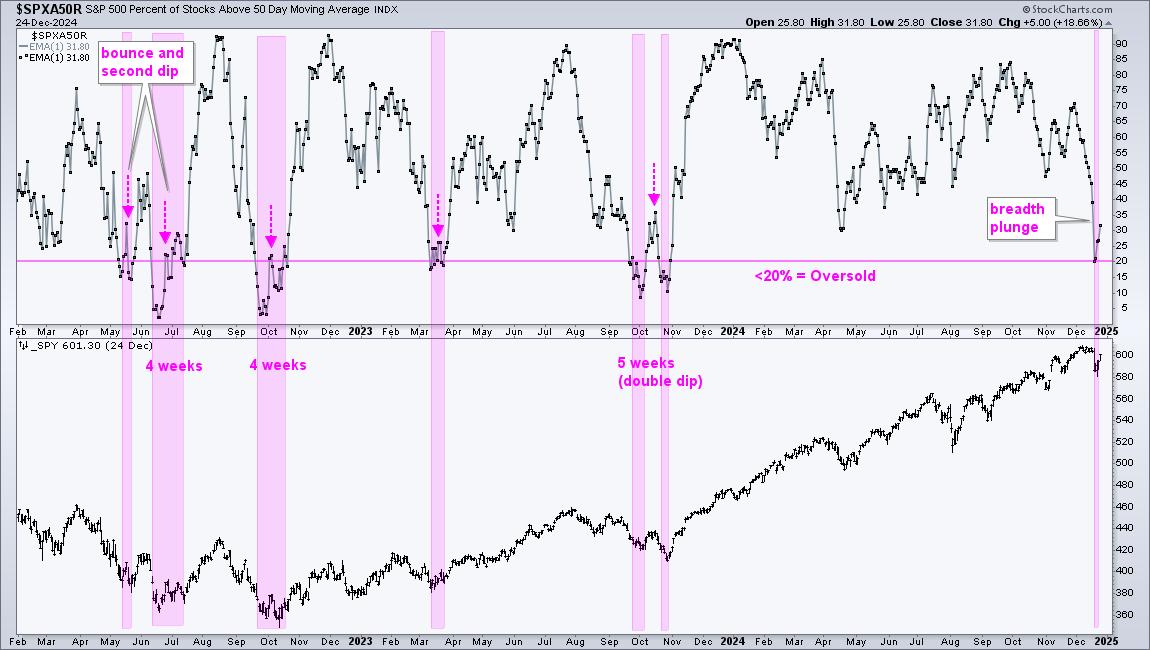

In this edition of StockCharts TV's The Final Bar, Joe Rabil of Rabil Stock Research walks through his monthly, weekly, and daily S&P 500 charts to put the recent market pullback into proper long-term context. Host David Keller, CMT digs into breadth indicators that have turned quite negative and why the Bullish Percent Index deserves our attention.

This video originally premiered on September 27, 2023. Watch on our dedicated Final Bar page on StockCharts TV, or click this link to watch on YouTube.

New episodes of The Final Bar premiere every weekday afternoon LIVE at 4pm ET. You can view all previously recorded episodes at this link.

And don't miss some of our other recent editions of the show below!

In the September 26 edition, Tom Bowley of EarningsBeats shows how previous pullbacks have ended with capitulation patterns, none of which we've seen yet in September 2023. Meanwhile, Dave highlights breakdowns from key mega cap names including AMZN and GOOGL, and how yields on bonds now exceed yields on stocks.

In the September 25 edition, Dave focuses on two potential ways to describe the recent action for the S&P 500 - a head-and-shoulders topping pattern vs. an ABC correction. He opens the Final Bar Mailbag and answers questions on position sizing, inverted yield curves, and which industries perform well during periods of stagflation.

Finally, in the special September 22 all-Mailbag edition, Dave explores topics such as the impact of rising interest rates on SMH, insights from trading legend Jesse Livermore in a down market, organizing StockCharts features, and scanning for stocks with strong relative strength. Plus, get Dave's tips on how to grow $2000 quickly to fund that dream Corvette.