What Investment Theme Will Lead the Market in 2023?

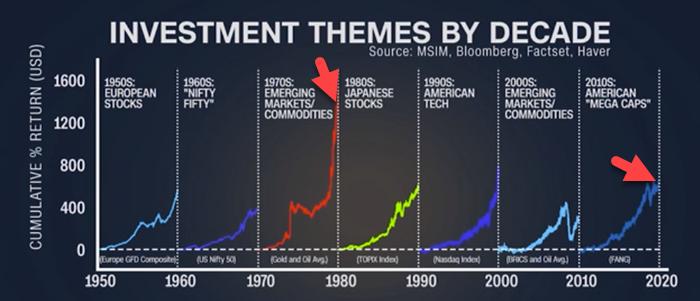

The Big View: Key Investment Themes by Decade 1950-2022. During the 1970s, commodities and emerging markets led with cumulative 1,500% USD returns.

Market leaders are constantly evolving and staying up to date on the newest trends, and macro events can be challenging. Looking back at previous decades of market leadership provides insight into how market leaders change over time, and the impressive cumulative returns indicate potential future market leadership gains.

It may seem grim this week as tech stocks like Apple, TSLA, Meta, and other mega-cap names continue to fall, but history reminds us that new leaders are potentially emerging. Traders should stay attuned to shifting current market conditions to look for new leadership trends. It helps to have trading indicators and research tools to pinpoint changing market leadership.

So, what does all this mean for investment themes in 2023?

To stay on top of shifting market leadership, it is essential to be aware of the key factors that signal changing leadership. Our Triple Play Indicator can help signal and alert traders where and when capital should be deployed based on market leadership.

The last decade had a fantastic run for large-cap growth stocks, and the FAANGs dominated until the beginning of 2022. Given the crypto winter and current crypto FTX crisis, a shifting macro backdrop might usher in fresh leadership, similar to commodities emerging in the 1970s with precious metals gaining astronomical returns. It is also consistent with our view that we are in a comparable inflationary environment to the 1970s.

Real assets, particularly gold, exemplify potential new leadership emerging. The Triple Play indicator measures price leadership and volume strength, and gold outperforms the SPY ETF above. When the Triple Play blue line is above the red line, it's bullish. It highlights that gold will likely continue to rally while its trend is strengthening.

The indicators and data provided by our Triple Play Indicator can help you stay ahead of shifting market leadership so you can adjust your trades accordingly.

Rob Quinn, our Chief Strategy Consultant, can provide pricing and trading software compatibility and a one-to-one trading consult to learn more about Mish's Premium trading service. Our Real Motion Indicator and TriplePlay Indicator are available on trading platforms such as StockCharts, Fidelity, and TradeStation.

"I grew my money tree and so can you!" - Mish Schneider

Get your copy of Plant Your Money Tree: A Guide to Growing Your Wealth and a special bonus here.

Follow Mish on Twitter @marketminute for stock picks and more. Follow Mish on Instagram (mishschneider) for daily morning videos. To see updated media clips, click here.

Mish in the Media

Read Mish's latest article for CMC Markets, titled "What's Next For Key Sectors After the Midterms".

Mish explains why MarketGauge loves metals and is still patiently loading up equities on Business First AM.

Mish talks metals, rates, dollar, and which sector to buy/avoid in this appearance on UBS Trending.

See Mish talk with Charles Payne on Making Money about the Oil markets testing the limits of Fed policy, China, and what to buy in the metals.

Mish joins Cheddar to talk about some of the fallout from the most recent Fed Meeting.

See Mish join Neil Cavuto and Eddie Ghabour on Cavuto Coast to Coast to talk about the Fed's recent rate hike decision.

Click here to see Mish and Helene Meisler's panel at the Trader's Summit event!

Mish discusses Meta and Palantir and how trends are switching in this appearance on BNN Bloomberg.

ETF Summary

S&P 500 (SPY): 369 support, 377 resistance. Russell 2000 (IWM): 171 support, 177 resistance. Dow (DIA): 321 support, 329 resistance. Nasdaq (QQQ): 260 support, 265 resistance. KRE (Regional Banks): 60 support, 65 resistance; same as before. SMH (Semiconductors): 189 support, 197 resistance. IYT (Transportation): 208 support, 214 resistance. IBB (Biotechnology): 127 support, 132 first resistance; same as before; closed at 129.05. XRT (Retail): 58 support, 63 resistance; same as before; closed at 59.41.Keith Schneider

MarketGauge.com

Chief Executive Officer

Wade Dawson

MarketGauge.com

Portfolio Manager