Here’s A Chart Flashing A MAJOR Buy Signal During This Selloff

Ever heard that old saying, "Don't judge a book by its cover?" Well, that's what I'd say looking at this Fed-induced selloff. While we're seeing a lot negativity, let's not forget first and foremost that it's options-expiration week. 24 hours ago, there were millions and millions of net in-the-money call premium. Ummmm, not any more! POOF!!!!!!

The market makers have done it again, managing to wipe out a lot of call premium just when they needed it most. Let's give them a hand, shall we? (sarcasm intended)

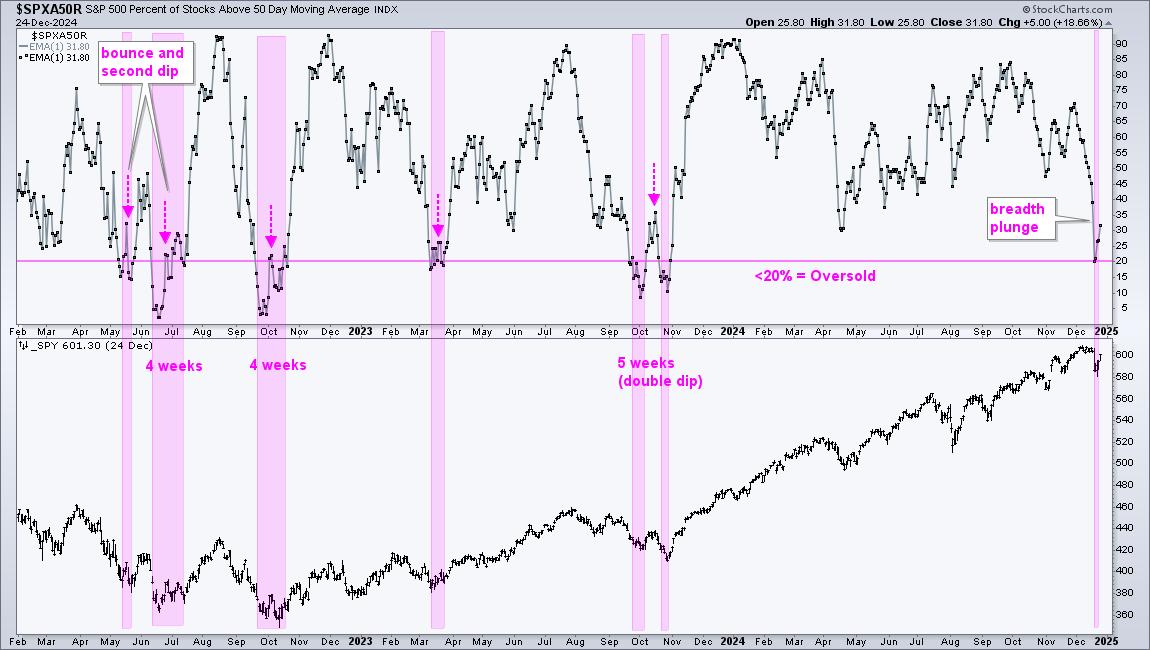

So is the selling the real deal? I say NO. I believe the big Wall Street firms are using this latest round of selling to pour into their favorite aggressive growth stocks. But don't take my word for it. Check out this chart and let me know if you have a different interpretation:

While the SPY has been selling, money is actually rotating more towards growth vs. value. The one exception is the XLY:XLP, which has continued marching lower because of the relative weakness in Amazon.com (AMZN) and Tesla, Inc. (TSLA). These two account for nearly half of the XLY performance. All other key growth vs. value ratios have been printing higher lows while the SPY finds lower lows. I've drawn a black-dotted vertical line to separate the data before November 10th from the period after. This way, we can focus on what's been happening in the market since the new inflation data was released.

Earlier this year, on Saturday, January 8, 2022, I predicted big trouble ahead, in part due to Wall Street firms repositioning into value stocks (vs. growth) while the indices were moving to all-time highs. Now we have the reverse in place. The SPY is setting new recent lows and challenging the key gap support from November 10th, while money is clearly rotating into growth stocks. The bond market is confirming this bullish action as the 10-year treasury yield ($TNX) has dropped 88 basis points from 4.33% on October 21st to 3.45% this morning. Lower interest rates add value to the market caps of growth stocks. We're not really seeing it yet, but Wall Street is prepping for it.

You won't want to miss MarketVision 2023, to be held on Saturday, January 7, 2023. It's a FREE virtual event and will feature the following speakers:

Tom Bowley, Chief Market Strategist, EarningsBeats.com David Keller, Chief Market Strategist, StockCharts.com Grayson Roze, Vice President of Operations, StockCharts.com Julius de Kempenaer, Director of Data, StockCharts.comThis event will fill up fast, so be sure to CLICK HERE and register with your name and email address to save your seat. I look forward to seeing you there!!!

Tom